That said most hedge funds wont trade penny stocks on the long side. While many financial institutions are prohibited from trading penny stocks loosely regulated hedge funds have no such restrictions.

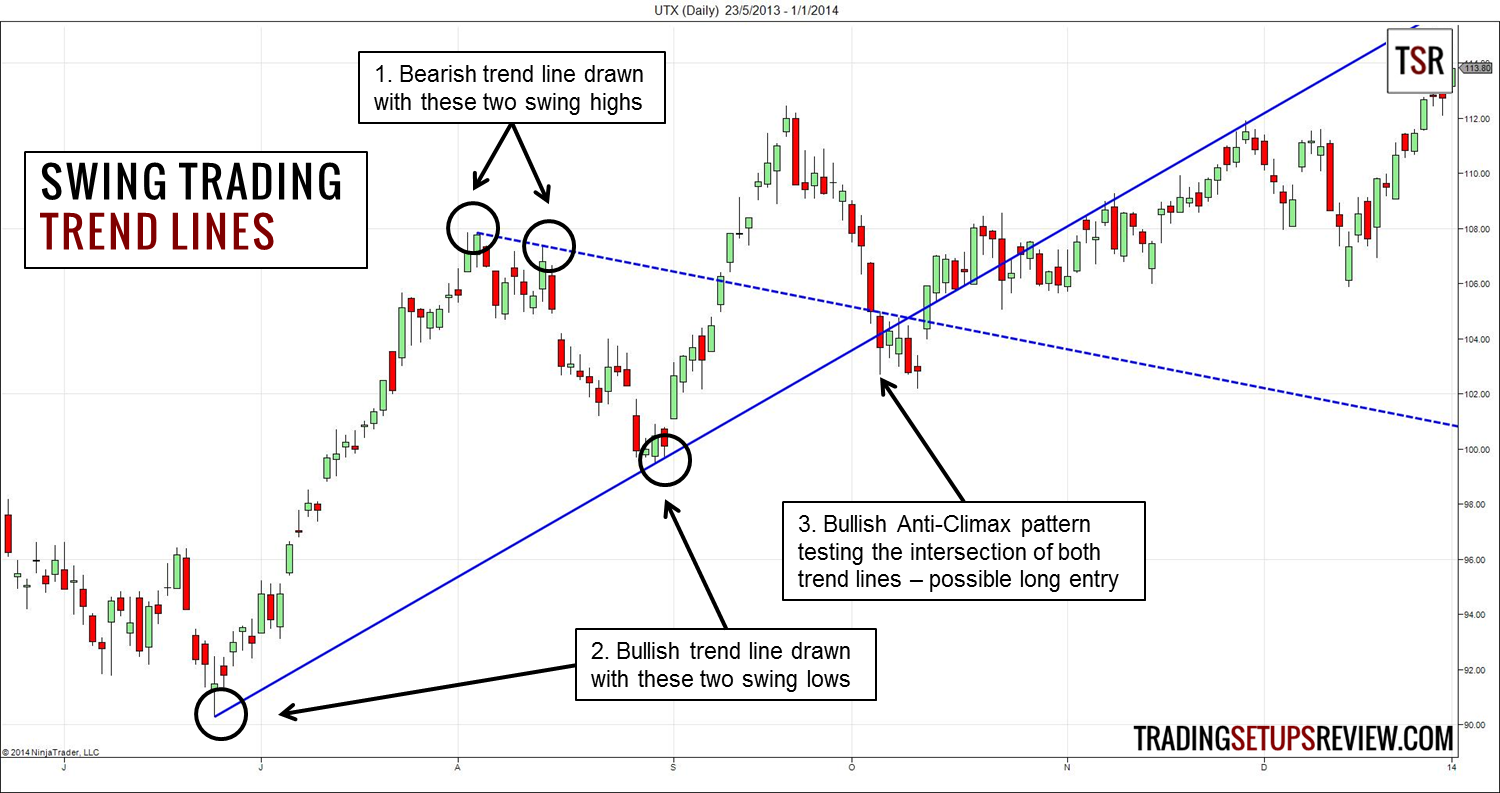

Trade using the larger daily timeframe and hang on to your trades for many many days or weeks until you get stopped out of your trade with a profit or you take profit target is hit.

Any hedge funds that only do day or swing trade. Most wall street traders get paid to day trade other peoples money thats a huge difference compared to what most stay at home day traders do. Hedge funds strategies. The goal of hedging is not to increase the profits for a trader.

They far prefer short selling penny stocks that look to have peaked after being heavily promoted. Hedge fund traders can be daytraders and daytraders can be hedge fund traders the two are not mutually exclusive. The average hedge fund trader gets.

Hedge fund traders would not last a day trading in a real retail market. You hedge an investment by making another investment. Why do so many hedge fund managers focus on momentum trading.

These top hedge funds and investors do not day trade swing trade or stare at computer screens. The average professional trader gets paid somewhere between 1 and 3 of assets per year just to trade those assets all day. This way hedge funds can eliminate some of the risks associated with holding a trade overnight.

Well usually when youre trading on a short term basis like when there is a breakout or big news that accelerates a move youre in the market only for a short period of time. 5 key tips to follow. This is why they deserve higher fees than a long only buy and hold investor.

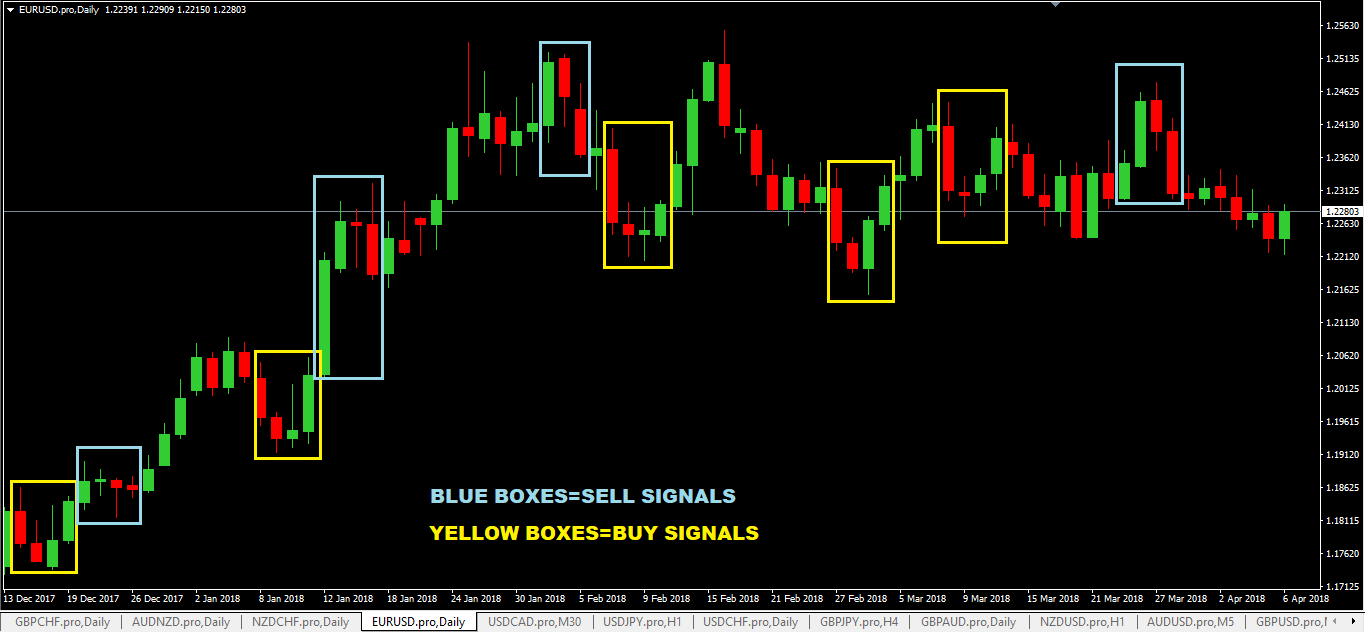

With this hedge fund swing trading system it can take only one trade to make 300 or 500 pips in a trade. They are insiders who leverage inside information and connections using extensive amounts of resources to make a relatively small but basical. Hedge funds are not day traders.

Hedge fund traders can not take any time frame they see fit on a given position they trade according to the funds strategy. Not in the traditional sense daytrading typically is marked by taking home zero overnight risk. Here are the differences as well as some pros and cons.

Hedging trading prepare your process. That is an urban legend perpetuated by the brokerage houses to get you to trade as much as possible so they can get your commissions. As a trading strategy hedging is a complicated process which entails the use of two securities or assets which have a negative correlation.

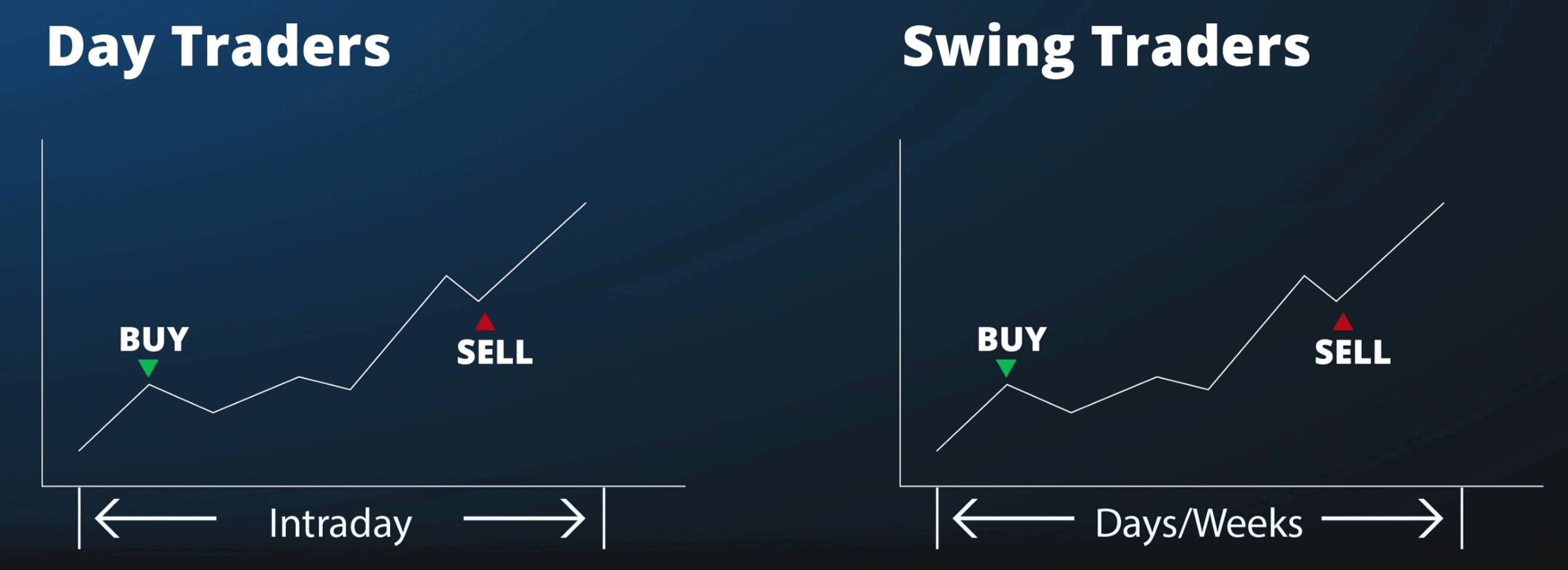

Day trading involves making dozens of trades in a single day while swing trading involves holding positions over a period of days or weeks. Hedge funds will gladly and regularly do take advantage of intraday market dislocations though brought upon by headlines or other macro incidents.

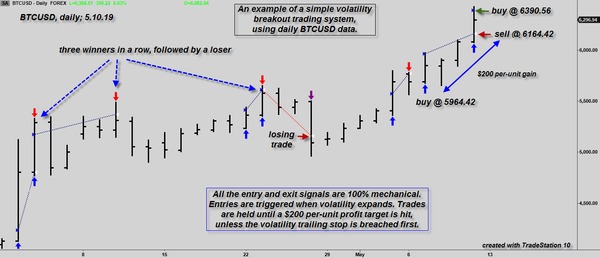

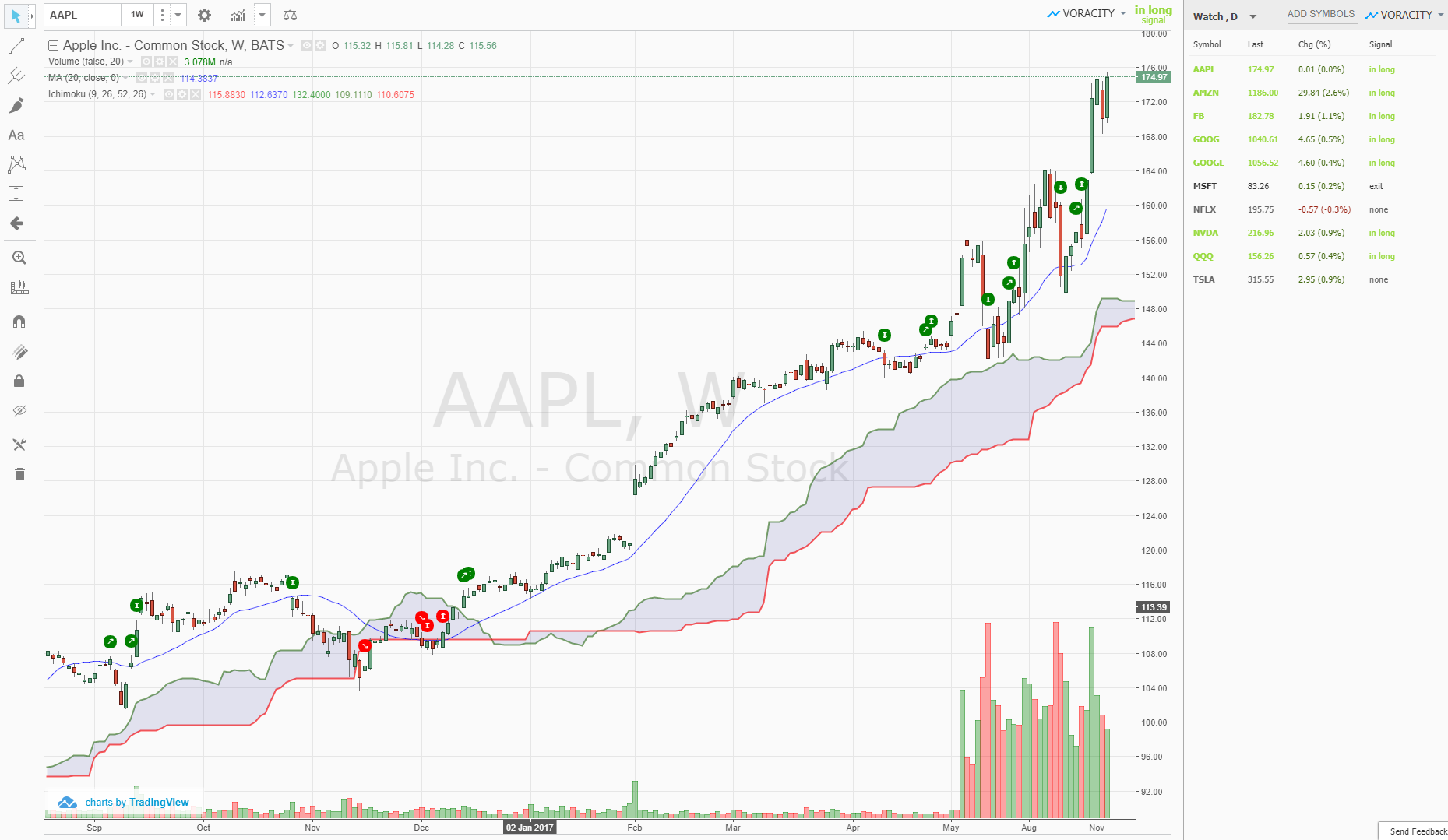

Hedge Fund Forex Trading System For Swing Trading Forex Trading 200

Hedge Fund Forex Trading System For Swing Trading Forex Trading 200

Lulu Stock A Position Trade Or Swing Trade Investor S Business

Lulu Stock A Position Trade Or Swing Trade Investor S Business

4 Simple Scalping Trading Strategies And Advanced Techniques

4 Simple Scalping Trading Strategies And Advanced Techniques

Stock Market Correction Fears Spark Selling Investor S Business

Stock Market Correction Fears Spark Selling Investor S Business

Hedge Fund Forex Trading System For Swing Trading Forex Trading 200

Hedge Fund Forex Trading System For Swing Trading Forex Trading 200

/best-free-stock-screeners-to-find-stocks-for-day-trading-1031379-A-v1-5b71eb9546e0fb0050e0e321.png) Free Day Trading Stock Screeners

Free Day Trading Stock Screeners

Hedge Fund Strategies And Tools Used On Wall Street

Hedge Fund Strategies And Tools Used On Wall Street

Deron Wagner Blog Crispr Therapeutics Trade Review How We

Deron Wagner Blog Crispr Therapeutics Trade Review How We

Which Is More Profitable Day Trading Or Swing Trading Quora

Swing Trading Strategies Cutting Losses Investor S Business Daily

Swing Trading Strategies Cutting Losses Investor S Business Daily

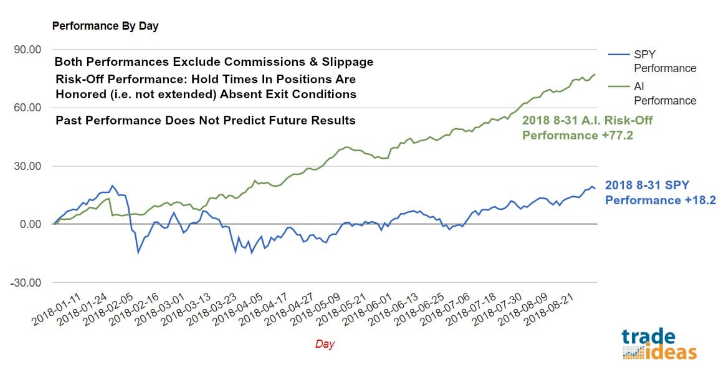

Leveraging Artificial Intelligence For Swing Trading Outperformance

Leveraging Artificial Intelligence For Swing Trading Outperformance

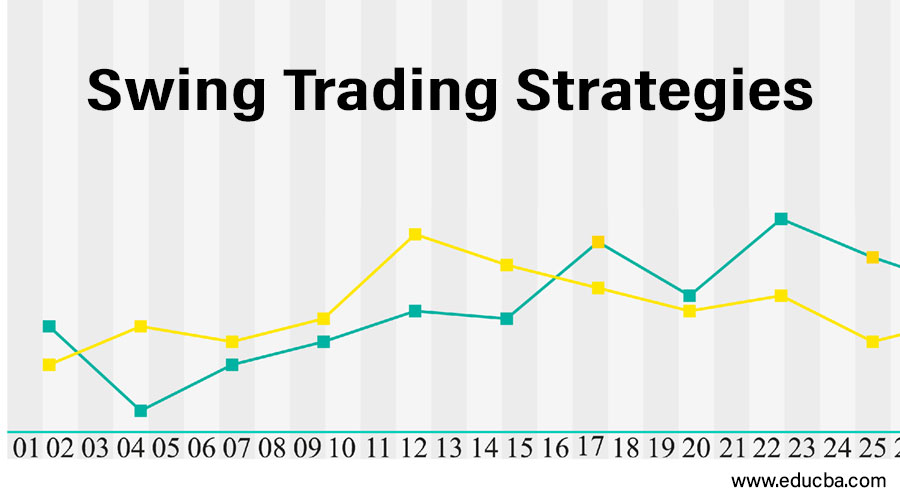

Swing Trading Strategies Different Steps In Swing Trading Strategies

Swing Trading Strategies Different Steps In Swing Trading Strategies

Swing Trading What It Is Plus Key Strategies Tips

Swing Trading What It Is Plus Key Strategies Tips

How To Make Money Swing Trading Apply Defense In Choppy Stock Market

How To Make Money Swing Trading Apply Defense In Choppy Stock Market

Swing Trade In Biotech Sector Gave Best Of Both Worlds

Swing Trade In Biotech Sector Gave Best Of Both Worlds

Day Trading Versus Swing Trading Which Is Better

Day Trading Versus Swing Trading Which Is Better

How To Day Trade Volatility Etfs

To Day Trade Or Swing Trade Day Trading Vs Swing Trading Blog

To Day Trade Or Swing Trade Day Trading Vs Swing Trading Blog

Council Post How Hedge Funds Invest Three Practical Steps To

Council Post How Hedge Funds Invest Three Practical Steps To

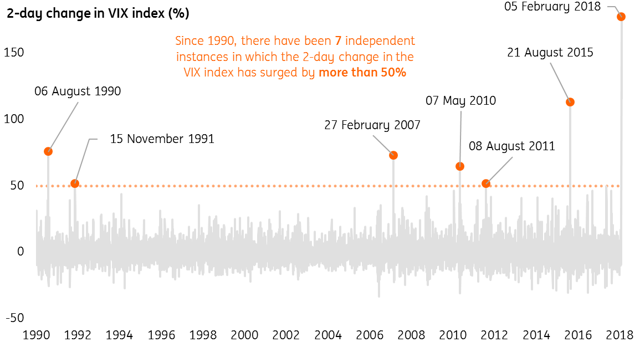

Volatility Trading Styles Seeking Alpha

Volatility Trading Styles Seeking Alpha

Top 3 Simple Moving Average Trading Strategies

Top 3 Simple Moving Average Trading Strategies

Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcsio1t5ibcqwt Amsrtr49bksz F4hvvzrjck2tkw0mckbhgznq

Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcsio1t5ibcqwt Amsrtr49bksz F4hvvzrjck2tkw0mckbhgznq

How To Trade 2019 S Best Performing Leveraged Sector Etfs

Positional Trading Strategy Trade Like A Hedge Fund Manager

Positional Trading Strategy Trade Like A Hedge Fund Manager

11 Important Lessons Learned Swing Trading In 2018 How We

11 Important Lessons Learned Swing Trading In 2018 How We

Definitive Guide On Swing Trading Definition And Strategies

Definitive Guide On Swing Trading Definition And Strategies

Position Trading Market Timing Mastery Trade Like A Hedge Fund

Position Trading Market Timing Mastery Trade Like A Hedge Fund

Gold Price Futures Gc Technical Analysis Hedge Funds Long

Gold Price Futures Gc Technical Analysis Hedge Funds Long

Different Types Of Forex Swing Trading Strategies That Work

Different Types Of Forex Swing Trading Strategies That Work

Learn Day Trading And Swing Strategy Stock Strategies Class Udemy

Learn Day Trading And Swing Strategy Stock Strategies Class Udemy

Analyzing The Performance Of A Profitable Trader Why You Need A

Analyzing The Performance Of A Profitable Trader Why You Need A

Swing Trading Ninja 12 Hour Complete Swing Trading Strategy Udemy

Swing Trading Ninja 12 Hour Complete Swing Trading Strategy Udemy

Swing Trading Strategies That Work

Swing Trading Strategies That Work

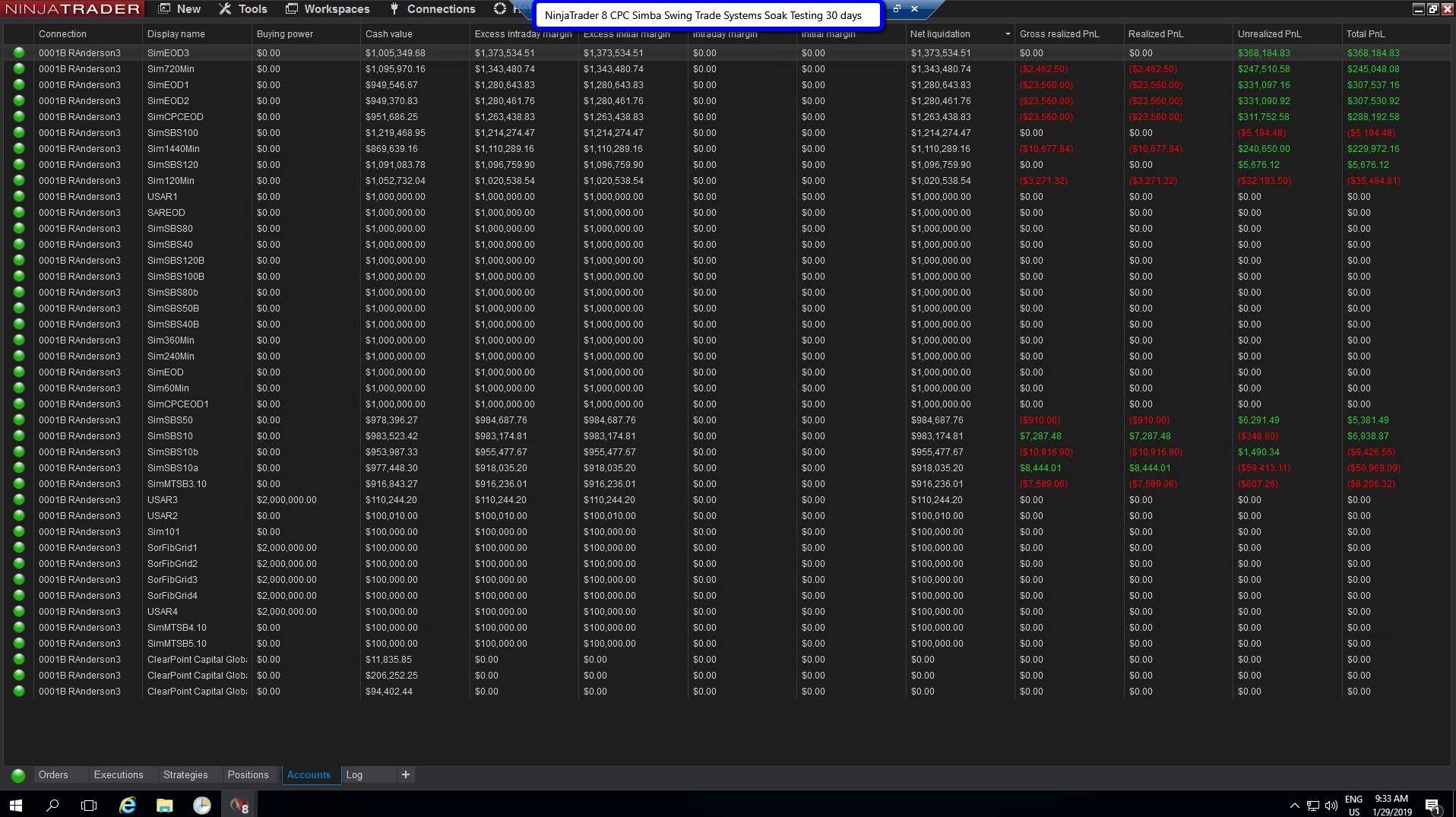

Ninjatrader Automated Futures Swing Trading Portfolio Trading System

Ninjatrader Automated Futures Swing Trading Portfolio Trading System

Swing Trading For Beginners 7 Golden Rules For Making A Full Time

Swing Trading For Beginners 7 Golden Rules For Making A Full Time

How To Be A Successful Hedge Fund Trader Youtube

How To Be A Successful Hedge Fund Trader Youtube

Day Trading Salary See How Much Top Traders Make A Year

Day Trading Salary See How Much Top Traders Make A Year

11 Important Lessons Learned Swing Trading In 2018 How We

11 Important Lessons Learned Swing Trading In 2018 How We

Shorting Parabolic Stocks For Beginners 2020 Warrior Trading

Shorting Parabolic Stocks For Beginners 2020 Warrior Trading

Would It Be Smarter To Invest Time And Money In Day Trading Or

The 7 Factors That Hold People Back From Day Trading

The 7 Factors That Hold People Back From Day Trading

How To Transfer Stocks Between Brokerages M1 Finance

How To Transfer Stocks Between Brokerages M1 Finance

Why Swing Trading Gives You The Best Chance To Succeed Learn To

Why Swing Trading Gives You The Best Chance To Succeed Learn To

Trading Strategies 11 Of Our Favorites To Use With A Stock Scan

Trading Strategies 11 Of Our Favorites To Use With A Stock Scan

Swing Trading For Those Who Love Fundamentals

Swing Trading For Those Who Love Fundamentals

Hedge Fund Forex Trading System For Swing Trading Forex Trading 200

Hedge Fund Forex Trading System For Swing Trading Forex Trading 200

Day Trading For Dummies By Ann C Logue Paperback Barnes Noble

Day Trading For Dummies By Ann C Logue Paperback Barnes Noble

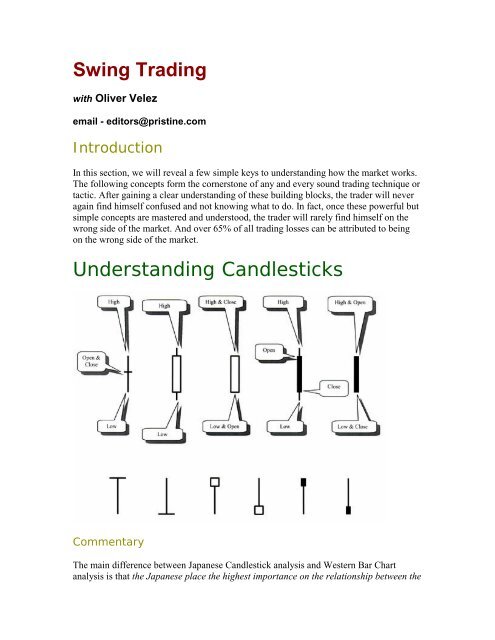

Swing Trading With Oliver Velez Pdf Mirror Trading Forex Trading

Swing Trading With Oliver Velez Pdf Mirror Trading Forex Trading

Hedge Fund Managers Who Got Rich From Trading And Their Strategies

Hedge Fund Managers Who Got Rich From Trading And Their Strategies

Part 3 Swing Trading Cryptoweek Medium

Part 3 Swing Trading Cryptoweek Medium

Day Trading Vs Swing Trading Top 5 Best Differences With

Day Trading Vs Swing Trading Top 5 Best Differences With

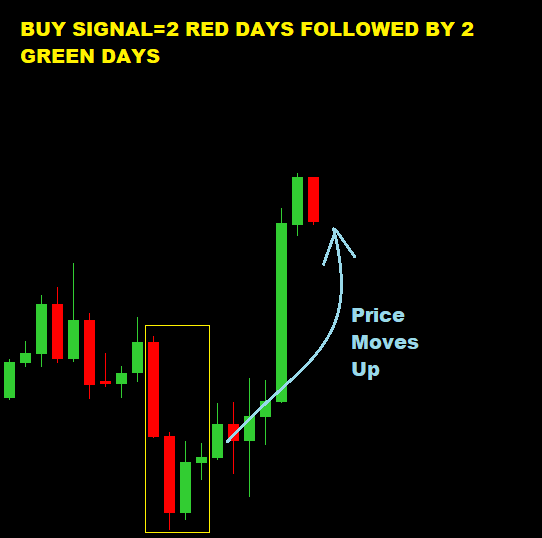

Our Guide To Understanding Candlesticks How To Trade With Them

Our Guide To Understanding Candlesticks How To Trade With Them

Why Indexers Are Toast Seeking Alpha

Why Indexers Are Toast Seeking Alpha

Stock Patterns For Day Trading And Swing Trading Barry Rudd

Stock Patterns For Day Trading And Swing Trading Barry Rudd

Hedge Fund Stars Are Losing Their Sway

Hedge Fund Stars Are Losing Their Sway

Convergence Trading Hedge Fund Strategies

Convergence Trading Hedge Fund Strategies

How To Build Your Bitcoin Trading System 2 Trading Strategies

How To Build Your Bitcoin Trading System 2 Trading Strategies

Three Swing Trading Strategies New Trader U

Three Swing Trading Strategies New Trader U

Swing Trading For A Living From Home Guerillastocktrading

Swing Trading For A Living From Home Guerillastocktrading

What Do Hedge Funds Think Of Technical Analysis Hedge Think

What Do Hedge Funds Think Of Technical Analysis Hedge Think

Forex 15 Min Scalping Strategy

Swing Trading And Wealth Building Youtube

Swing Trading And Wealth Building Youtube

Hedge Funds Keep Failing To Deliver On What They Re Selling

Hedge Funds Keep Failing To Deliver On What They Re Selling

Tradingmarkets Swing Trading College 2019

Tradingmarkets Swing Trading College 2019

Swing Trading Strategy Basics Turning Small Gains Into Big Profits

Swing Trading Strategy Basics Turning Small Gains Into Big Profits

Basecamp Trade Consistently With Better Tools And Proven Strategies

Basecamp Trade Consistently With Better Tools And Proven Strategies

Finviz Review Is It Worth Using Here Are The Facts

Finviz Review Is It Worth Using Here Are The Facts

Vantage Point Trading Why Most Traders Lose Money And Why The

Vantage Point Trading Why Most Traders Lose Money And Why The

The Beginners Guide To Day Trading Insidebitcoins

The Beginners Guide To Day Trading Insidebitcoins

Weekend Day Trading Is It Possible And What You Need To Be Aware

Weekend Day Trading Is It Possible And What You Need To Be Aware

How To Trade Using The Reward To Risk Ratio 10 Days To Master

How To Trade Using The Reward To Risk Ratio 10 Days To Master

Would It Be Smarter To Invest Time And Money In Day Trading Or

How To Day Trade For A Living Audiobook By Andrew Aziz Audible Com

How To Day Trade For A Living Audiobook By Andrew Aziz Audible Com

Why Swing Trading Gives You The Best Chance To Succeed Learn To

Why Swing Trading Gives You The Best Chance To Succeed Learn To

Column Hedge Funds Turn Bearish On Oil As Economy Slows Kemp Nasdaq

Council Post How Hedge Funds Invest Three Practical Steps To

Council Post How Hedge Funds Invest Three Practical Steps To

True Trading Group Llc Claim What S Yours Milled

True Trading Group Llc Claim What S Yours Milled

How To Become A Professional Trader

How To Become A Professional Trader

Election Volatility Strategies To Protect Your Portfolio Against

Election Volatility Strategies To Protect Your Portfolio Against

Day Trading Vs Swing Trading Top 5 Best Differences With

Day Trading Vs Swing Trading Top 5 Best Differences With

Hedge Fund Strategies And Tools Used On Wall Street

Hedge Fund Strategies And Tools Used On Wall Street

Day Trading And Swing Trading The Currency Market Ebook By Kathy

Day Trading And Swing Trading The Currency Market Ebook By Kathy

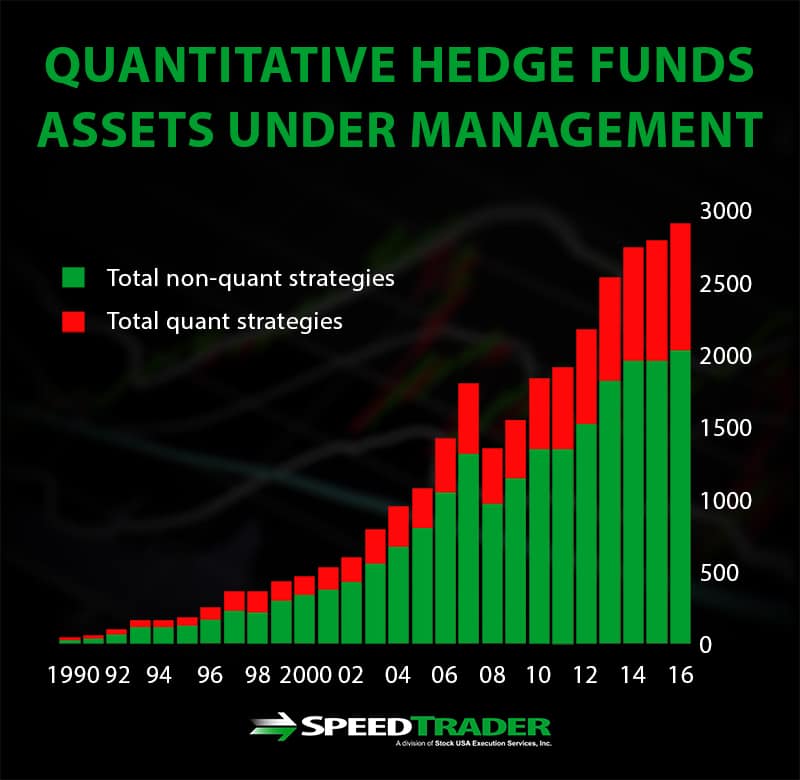

Quantitative Trading An Introduction For Investors

Quantitative Trading An Introduction For Investors

Easy 5 Step Fibonacci Swing Trading System Review

Easy 5 Step Fibonacci Swing Trading System Review

Swing Trading Based On Artificial Intelligence Returns Up To

Swing Trading Based On Artificial Intelligence Returns Up To

Day Trading And Swing Trading The Currency Market Technical And

Day Trading And Swing Trading The Currency Market Technical And

/day-trading-versus-swing-trading-58d2b0783df78c5162052d77.jpg)

0 Response to "Any Hedge Funds That Only Do Day Or Swing Trade"

Post a Comment